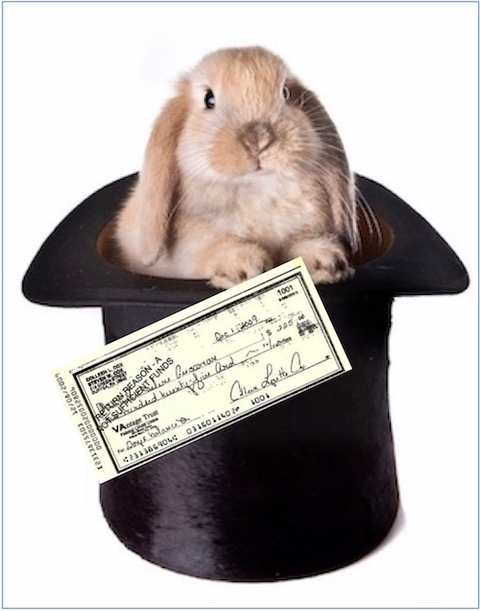

As a credit and collection professional for a few decades, I’ve seen my share of ploys by debtors who have attempted to show they have paid. At a minimum, this illusion is an effort to buy a little more time to eventually make a legitimate payment. At a maximum, it’s an endeavor to completely maneuver out of the payment obligation.

As a credit and collection professional for a few decades, I’ve seen my share of ploys by debtors who have attempted to show they have paid. At a minimum, this illusion is an effort to buy a little more time to eventually make a legitimate payment. At a maximum, it’s an endeavor to completely maneuver out of the payment obligation.

Sometimes these impressions have been very creative. For example, at first glance of a copy of a cleared check, we’ve asked the creditor to verify if payment was posted in error to another account, which can easily happen from time to time. When speaking with a debtor who comes to the phone and demonstrates a proactive attitude to resolve the debt, it’s natural to assume that the copy of the cleared check sent over is legitimate.

However, when a debtor’s behavior towards the debt is passive, evasive, aggressive, or deceptive, the efforts to falsely demonstrate that a payment has been made can be far reaching.

Here are a few of the more elaborate illusions that I’ve come across below:

-

- Creating a check for the correct amount but sending it with a copy (by fax or email attachment) of the reverse side of another check from a previous payment to the creditor to show that the check had cleared the creditor’s bank;

- Creating the reverse side of a check that included several unrelated processing numbers, giving the appearance the check cleared;

- Sending a copy of a check where the creditor’s name was written slightly askew, giving the appearance the check might not have been properly processed on the creditor’s side. For example, instead of sending the check made payable to ABC Tool Co., Inc., the check was made payable to AB Tools Limited.

- Sending a copy of a wire transfer application which showed elaborate but hard to read confirming bank seals and other details;

In addition, when the person in charge at the debtor company has left, sometimes the owner or other person in charge may take advantage of the situation by:

-

- Changing the dates and content on emails indicating that certain agreements and discounts favorable to the debtor were made;

- Forging signatures on documents by the people who left the creditor company indicating particular arrangements were concluded;

- Recreating purchase orders that have different terms and conditions;

- Forging documentation that indicated the goods were returned;

- Announcing an impeding bankruptcy where no intent of bankruptcy existed;

- Forging letters from a law firm indicating that the company was in receivership.

When customers have reached the last two points of deception, we can probably assume that payment will not be forthcoming. Instead, it’s imperative to quickly search for and confirm potential assets that could be seized with a judgment in hand, as litigation will probably be your next best step. Your comments and experiences are most welcome.

All Rights Reserved

This article was edited by Steven Gan.